Do you fancy the Bajaj Avenger range of bikes?

The passion is justified because of the elegance and iconic status of the Avenger. It is a hidden gem among the wide range of bikes in the two-wheeler market. Buying Bajaj Avenger with outright cash can put pressure on your budget, especially when you are residing in big cities with higher costs of living.

Your solution is simple - finance your Bajaj Avenger 150 or 220!

To finance your dream bike, you can apply for a two-wheeler loan online. There are multiple online creditors who have a fairly lenient procedure to sanction loans. Due to the competition among the loan providers, two-wheeler loans have become easy to obtain with low-interest rates. With Bajaj Auto Finance, your loan is a merely three clicks away!

Must Read: How to Get a Two Wheeler Loan? (Get a Bike Loan in 4 Steps)

If you want to apply for a loan to buy Bajaj Avenger Street 150, 180, 220 or Cruise 220, here's what you need to do:

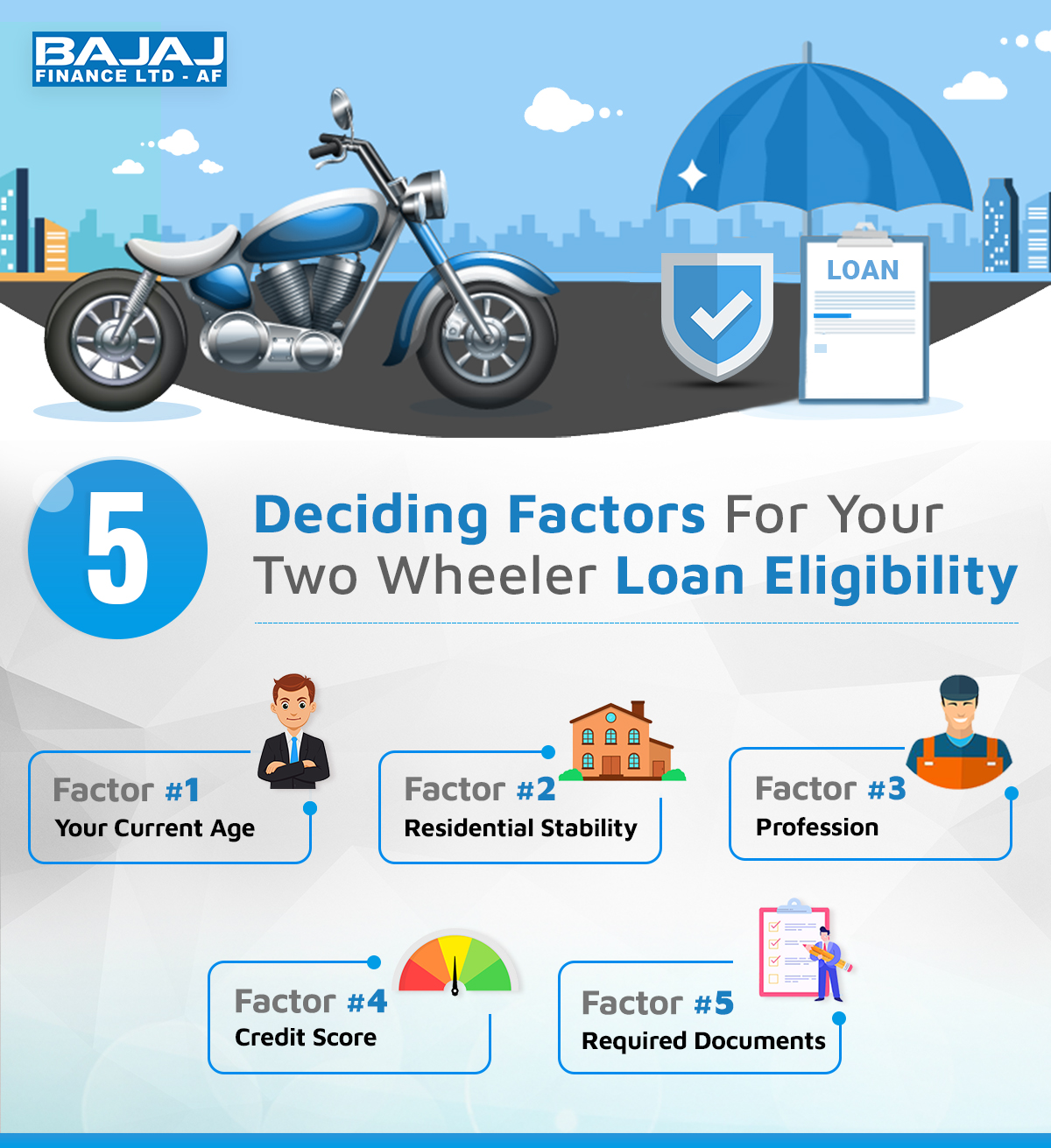

To apply for this type of loan, you need to meet the basic eligibility criteria:

Once you get your loan approved, you can walk into any Bajaj outlet and take home your dream bike. However, this will only be possible after your documentation has been verified. Here is a list of the necessary KYC documentation that most credit providers deem mandatory:

Must Read: What Documents are Required for a Two Wheeler Loan?

Bajaj Auto Finance is one of the most widely recommended and preferred FinTech solutions available in the market. It offers the best state-of-the-art technologies right from check handling to computerized loan account keeping. You can avail the fastest services while procuring a two-wheeler loan, which means faster loan processing and approval. In addition, there are loads of options to choose from like bike models and accessories.

Must Read: A Guide to Bajaj Auto Finance Loans

Apply for Loan Calculate Your EMI