EMI stands for Equated Monthly Installments. EMI provides you with ease repaying your loan over a period of time through fixed monthly payments. Every installment comprises of principal and interest component. In certain scenarios installment may be unequal and frequency can be quarterly.

You need to contact CIBIL or relevant credit bureaus to understand your credit score. We would further like to inform you that, as a member of CIBIL (Credit Information Bureau India Ltd) & as per regulatory guidelines, Bajaj Finance shares your payment status & history with CIBIL. Any late payments will reflect in CIBIL records which cannot be changed and has to be accurate and complete.

Yes. However, any approval will be based on two wheeler loan eligibility criteria.

You can check the list of documents to apply for a Bajaj Bike loan or a KTM loan by clicking here.

The interest rate on bike loans in India is not fixed. It differs from lender to lender. However, the average bike loan interest rate in India is 6.85% - 28.30% per annum.

There are many ways to ensure that one gets the lowest interest rate for a two-wheeler loan.

The primary step one can take is to borrow only when their credit score is excellent. The next step one can take is to make sure that their credit history is immaculate. The third step to getting low interest rates is to borrow only the required amount.

There are two types of loans. One is secured loans. The other is unsecured loans. A secured loan is a financial product where the lender lends money after the borrower submits a property as collateral. An unsecured loan is offered without asking the borrower to submit any of their property as collateral.

In the case of a two-wheeler loan, the financed bike itself is the collateral.

If the borrower defaults on the EMIs for the bike loan, then the lender can repossess the financed bike. The repossessed bike will then be auctioned off if the borrower still doesn’t pay the lender their dues.

There is no fixed upper limit for motorcycle loans.

Some lenders would lend not more than three lakhs to a borrower as a bike loan. Then some lenders are ready to pay up to six times the annual income of a borrower.

For the best results, it is best to consult with the spokesperson of a revered lender.

At the same time, one should remember that they will be able to afford the loan. In simple words, one must make sure that they can pay the EMIs of their hefty two-wheeler loan on time.

Failing to pay EMIs on time can prompt the lender to repossess the bike they have financed. At the same time, the credit score and credit history of the borrower would also sustain a massive blow.

Applying for a motorcycle loan is generally the first step one has to take before buying a bike in India. The reason is simple. The days when one could buy a motorcycle with cash are long gone. These days, even an entry-level motorcycle costs more than one lakh rupees.

Hence, a two-wheeler loan is the only way to buy a bike one wants or needs.

Often lenders need to accommodate the unique requirements of borrowers. One such requirement is whether one can apply for a bike loan without income proof. The answer to this unique question is yes. One can get a motorcycle loan without showing any proof of income. The condition is that the person would have to provide all pertinent documents. Furthermore, one would have to apply for the loan with a co-applicant. The role of the co-applicant will be that of a guarantor of the borrower.

The prices of motorcycles available in India have exponentially increased in the past couple of years. The situation has come to this. A 125 CC motorcycle now costs more than 1 lakh on the road.

Hence, a two-wheeler loan is a must for people willing to buy a bike. On top of this, financing a motorcycle allows one to keep their accumulated disposable cash reserves untouched. By keeping accumulated disposable cash reserves untouched, one would have cash ready to serve their interests on a rainy day.

Furthermore, a bike loan also helps one to enhance their credit score and boost their credit history. An excellent credit score and history will help one get personal, business, home or car loans easily in the future.

Applying for a bike loan is easy these days. Whether one applies for a motorcycle loan offline or online, the application will be processed within a single business day.

However, there are some instances when a borrower’s two-wheeler loan application might get rejected. For example, if the borrower does not meet the eligibility criteria for a motorcycle loan offered by a lender.

Well, first, the borrower should be above 18. The borrower should also have to be a resident of India. The borrower should reside in the same city where they are applying for the loan. If the borrower is below 18, they can apply for a loan with a guarantor who is 18+& if the borrower meets these terms, they are eligible for a motorcycle loan. It is as simple as that.

The cost of producing a motorcycle these days is very high. The raw materials needed to make a bike entail hefty price tags. Hence, motorcycle manufacturers in India periodically have to revise the prices of their bikes. The outcome is that even entry-level motorcycles now cost more than a lakh INR.

Furthermore, bike buyers now look for a suitable two-wheeler loan first even before stepping inside a bike dealership.

A bike loan allows a buyer to buy their favourite motorcycle by paying a minimum downpayment. A downpayment is the minimum price one pays at the bike dealership for a bike. The rest of the bike’s MSRP is covered by the lender. One can also choose a 0 downpayment loan. The benefit of a 0 downpayment loan is that one can take their bike home, without paying any downpayment.

The answer is, no. Any type of loan, whether it is a two-wheeler loan or a personal loan, entails an agreement. In simple words, the agreement terms for a motorcycle loan will be different than the agreement terms of a personal loan.

If one uses the motorcycle loan fund to meet their personal needs, they will violate the loan agreement terms. On top of this, it is impossible as the lender will keep tabs on the money. It means if the lent money is not spent to buy a bike, the lender will penalise the borrower.

Yes! You can send a SMS to our SMS service number 9223192235 by typing NOC from your registered mobile number. NOC will be issued once the loan tenure is completed and all dues are received as well as your vehicle RC number is updated with us. Please refer point 7 to make online payments.

| + |

How can I check my Loan Account Number, Current Month EMI Status, Outstanding Dues (EMI and Penalty Charge), Foreclosure Amount with Validity Period, Payment Link to pay the dues or Foreclosure amount instantly? |

Your loan status and details are just a miss call away! You can use Missed Call Self-Service at 97177 52222 and get below service information in one SMS response.

The call will get disconnected automatically and an SMS will be sent to the registered mobile number of the customer.

Yes! You need to login to our website www.bajajautofinance.com/home/getlogin with login credentials like registered mobile, Loan account number and Date of Birth OR login with OTP on your registered mobile number. Your loan account information will be displayed on the screen after login.

Yes! You need to login to our website https://www.bajajautofinance.com/home/getlogin with login credentials like registered mobile, Loan account number and Date of Birth OR login with OTP on your registered mobile number. Your loan account information will be displayed on the screen after login.

You need to login to our website and raise a service request OR call our customer contact centre OR write an email to us with details of the request. Your email id will be updated in your loan records once it is validated by you through an auto generated email sent by us post updation.

You need to login to our website and raise a service request OR call our customer contact centre OR write an email to us with details of the request. Upon validation of your verification details, your mobile number will be updated in your loan account within 5 working days.

You need to provide a self attested copy of any KYC documents as mentioned below. You can send a scanned copy of documents to our customer care e-mail id bflcustomercare@bflaf.com or walk in to any of our branches along with your KYC documents. Acceptable KYC documents are; Aadhar Card, Valid Passport, Electricity bill, Water Bill, Telephone Bill (All bills shouldn’t be more than 2 months old), Election id card, Driving License etc.

| + |

Can I change my repayment mode (e.g. earlier provided cheques now wish to provide Auto Debit Mandate or NACH) at the time of providing the repayment mode from my new account/ bank? |

Yes, at the time of giving fresh repayment mode, you may also opt to change the repayment mode. For e.g. if you had given cheques earlier towards repayment of your loan, you can now opt to give an NACH/ Auto debit mandate. Also, refer FAQ points for more detailed information.

You need to login with the correct login credentials like registered mobile number, 14 digit loan account number and your date of birth. You can also login via OTP (One Time Pin) option on your registered mobile number. If you still face issues then please write to us on bflcustomercare@bflaf.com with the issue screenshot.

Yes! You can pay your installment and other penal dues online by login to loan account OR through quick pay option. After login, click on ‘Make Payment’ option to pay your outstanding dues through our secured payment gateway.

Yes! You can pay part/part foreclosure payment online by login to loan account on website. You need to login to our website https://www.bajajautofinance.com/home/getlogin with login credentials like registered mobile, Loan account number and Date of Birth OR login with OTP on your registered mobile number. Click on ‘Part Foreclosure’ and pay your part payment through our secured payment gateway.

You have to pay swapping charges of Rs. 590/- in case you want to change the repayment mode. These charges can be paid by way of DD drawn in favour of “Bajaj finance Ltd.” payable at Pune & dispatched along with fresh repayment mode to BFL, OR you can opt to directly pay the charges from your bank account through the Quick Pay option on our web site. Also, refer FAQ point 24 for more detailed information.

There are two mode of repayment /account for your loan available. 1. Mandate and 2. Post dated cheques(PDC)..

a) Mandate and National Automated Clear House – NACH, In case you have an account with any of Banks / branch we suggest you to confirm whether your bank participates in NACH clearing. You can check the same by visiting NACH website (Click on “NACH Live Banks”. If yes, you can download the FORM from the Form center).

b) Post-dated Cheques (PDC) - You also have the option of sending us fresh cheques for the balance tenure of your loan. Please ensure that the cheques are CTS - 2010 standard cheques.

| + |

Post submission of my documents, from what date will the change in repayment mode be effective, and how will I receive confirmation of the change? |

For mandate / cheques received by BFL at Pune on or before the 15th of the month the swap will be given effect from the immediate next month. If the mandates / cheques are received after the 15th of the month, the effect of change will be given from next to next month. For e.g. Your current due date is 8th of every month, and you send swap mandates/ cheques to BFL:

a) If the mandates / cheques are received on 13th March, the effect of change in bank account will be given in time for transactions to be presented on 8th April

b) If the mandates/ cheques are received on 19th March, the effect of change in bank account will be given in time for transactions to be presented on 8th May You will receive a SMS confirmation for effect given for such swap in repayment mode. The SMS will also mention the date from which the transaction will be presented on your new account.

You also have the option of calling us at our call center, or writing to us bflcustomercare@bflaf.com.

You can pay your outstanding dues amount by login to our website. You need login to our website www.bajajautofinance.com with login credentials like registered mobile, Loan account number and Date of Birth OR login with OTP on your registered mobile number. Also, you can approach nearest ICICI, Axis or Federal Bank to pay your due over the counter. You can download the Pay-in-slip from the “Form Center” menu option available in our website.

If your presented installment is dishonored or bounced, you will be charged Rs.531 per bounce (Applicable for loans disbursed w.e.f. 1st Aug 2017) and Rs.413 per bounce for loans disbursed prior to 1st Aug 2017. Also, if the outstanding dues are not paid within the same month then 3% Late Payment Penalty (Plus applicable GST) will be charged on the outstanding installment dues per month.

You can view our branches and their addresses in “Contact us” menu option on our website.

Vehicle Registration Certificate (RC) issuance is a state specific process which is issued by respective RTO office to the registered vehicle owner after registration of vehicle. The process of RC issuance may vary as per state specific rules. You may approach the dealership from where you have purchased the vehicle for the respective RTO office process for further guidance.

You may write to us in case of a query by accessing Complaints/Requests section of our website. If you are still not satisfied by the resolution provided, you may escalate to us as per Grievance Redressal policy.

Visit our Bajaj Finserv website or click here Fair Practices Code

Yes, you need to collect Non Objection Letter from BFL, for which you have to visit branch/ send by mail to bflcustomercare@bflaf.com or post to BFL address with necessary documents like request letter, new address proof , DOB proof, New residential land line number, New office land line number, New mobile number if changed for FI and update in our records and issue No Objection Letter accordingly

For Customers taken loan on corporate name from BFL, the GSTIN registration details can be updated with BFL. Please refer Form Center dropdown menu to download GSTIN update form. Same can be filled-up and duly signed by the customer. Further customer has to forward the updated form along with GSTIN registration copy & PAN number copy to bflcustomercare@bflaf.com. The same will be verified, updated and acknowledged within 2 working days. GST Credit Invoice needs to be requested on separate email @ bflcustomercare@bflaf.com

To know more on the Ombudsman Scheme, please click here Ombudsman Scheme

You can click Citizen's Charter to view BFL Citizen's charter.

Yes, you can stop NACH service at anypoint of time by submitting the online request form for NACH Cancellation available on our website, in the post login section.

Please click here to Login

Steps for cancellation of NACH services.

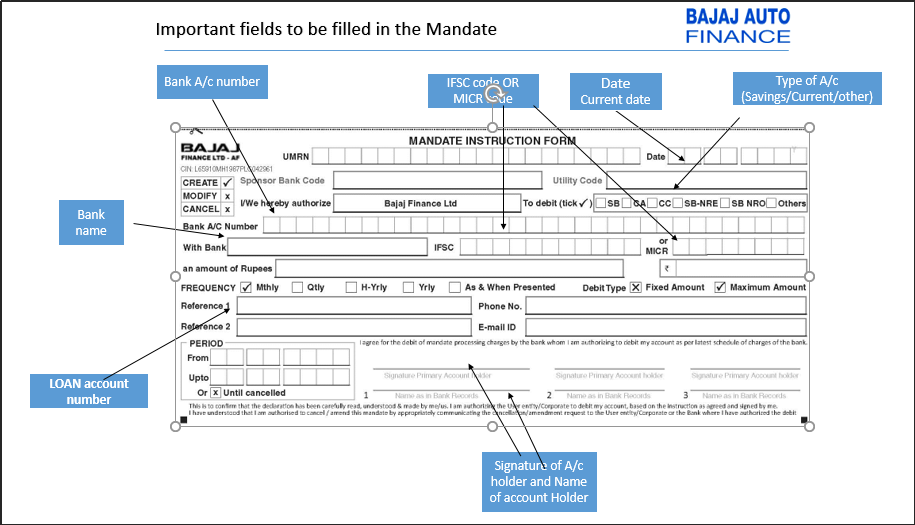

Process for Submitting fresh Mandate:-

Download the Mandate form from the Form center.

To ,

HO Repayment Team

Bajaj Finance Ltd

Old Pune Mumbai Road

AKURDI , PUNE – 411B0 35

|

Incorrect OTP

|

| Enter OTP |

| Please Enter OTP |

| Click here to Resend OTP |